Over the past 10 years (September 2013 to September 2023) the Nasdaq (QQQ etf) has returned more than +350%, while the S&P500 has returned about +200%.

For anybody thinking about day-trading, swing-trading, algo-trading, technical analysis and all of that nonsense, let’s look at the returns of some of the best Hedge Funds in the world, with huge resources and the best PhDs.

It’s surprisingly hard to find the actual 10-year returns of Hedge Funds. For some of them, you can sign up on their website and find it. On Stockcircle.com you can find a good list of Hedge Funds with their current assets and performances: the data is extracted from the official 13F filings.

Pollen Growth Fund, a fund that manages ~40B$, has returned +259% (source). Less than the Nasdaq.

Scion Asset Management (by Michael Burry, the genius in “The Big Short” movie) has returned around +300% in 10 years, less than the Nasdaq (source).

First Eagle Investments, has returned +80% (source), way less than the S&P.

Reinassance Technologies has returned +128% (source), less than the S&P.

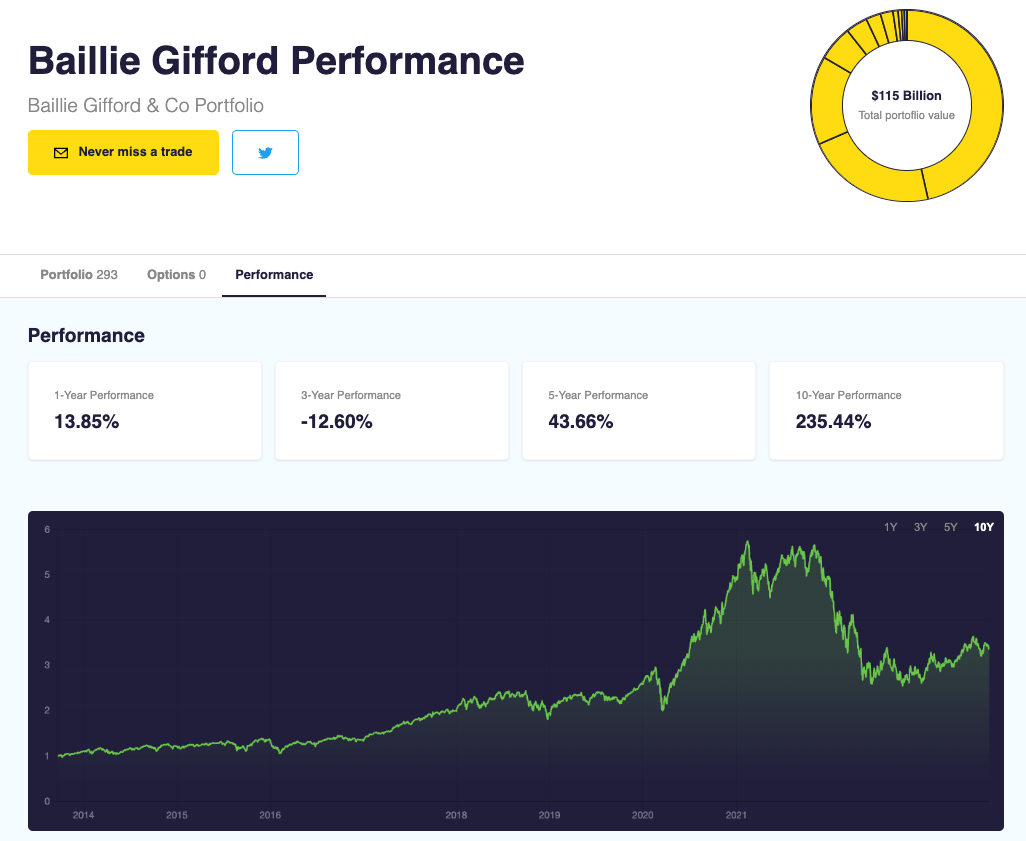

Baillie Gifford fund returned +235%. Less than the Nasdaq.

To be fair, we should measure also volatility and Sharpe ratios, but I don’t see how picking the right hedge fund can be less risky than just buying the S&P 500 index and sitting on you ass. Regardless of the Sharpe Ratio1.

By virtue of probability, some people will achieve better returns than the market. But that is true even if you run 1 million backtest simulations that pick random stocks: some of the simulations will perform better than the market, just by virtue of probability. Basically I’m saying that some people will beat the market because they are lucky, and some because they are good. It’s just really hard to know which is which, and overall it doesn’t seem to be worth it if you can do +300% by just buying the most liquid ETFs in the world and wait.

Surely, we just lived through the most ridiculous monetary expansion and tech boom in recent history, so we have to keep in mind these have been some incredible 10 years. So, it could happen next month that the Nasdaq or the S&P go -50% while these Hedge Funds, by virtue of having both long and short positions, perform better in the coming downturn. But would you bet that the average of Hedge Funds will beat the Nasdaq in the next 10 years?

But, for sure, I will not bet that the average of the top 20% retail traders will beat the Nasdaq in the next 10 years.

So, don’t trade. Buy an index and go have drinks.

Consider subscribing to this mailing list and following me on Twitter @AmacaCapital. Seeing the numbers go up makes me happy and keeps me going.

Sharpe Ratio is a common measure to estimate soundness of an investment. It corrects the average return of an asset by the dispersion of those.returns: mean(returns)/std(returns). It assumes that volatility is a reasonable measure of risk.